Wedoany.com Report-Nov. 10, NYSE- and TSX-listed Barrick Gold has completed the sale of its Alturas project in northern Chile to Singapore-based Boroo for $50 million in cash. Under the terms of the deal, Barrick will retain a 0.5% net smelter return (NSR) royalty on gold and silver production from Alturas, which will end after two million ounces of gold and gold-equivalent have been produced. Boroo has the option to repurchase the royalty for $10 million within four years.

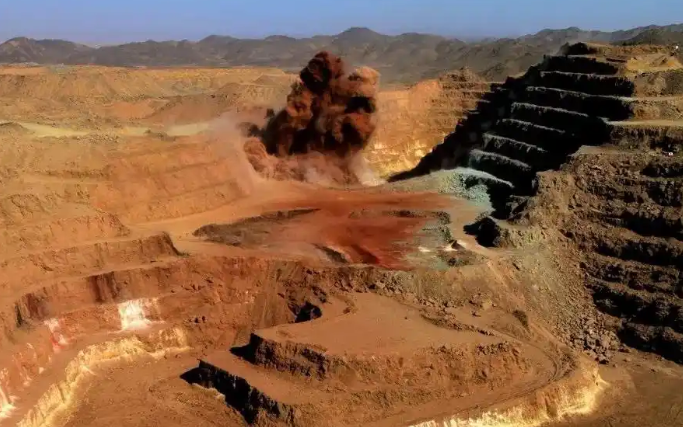

Boroo said the acquisition marks its entry into Chile and aligns with its strategy to become a mid-tier global metals producer with a diversified portfolio of long-life assets. Located in the prolific El Indio Belt near the Chile-Argentina border, Alturas is a high-sulphidation epithermal gold system discovered by Barrick in 2015. The project hosts indicated resources of 2.2 million ounces of gold and inferred resources of 3.6 million ounces, based on more than 130,000 meters of drilling.

“We are excited to complete the acquisition of the Alturas project,” said Boroo CEO Dulguun Erdenebaatar. “We look forward to advancing Alturas in a phased manner and building on Barrick’s legacy of constructive engagement with local authorities and communities. This also represents Boroo’s entry into Chile – a country with world-class copper potential – and an important step in broadening our strategy toward a more balanced gold and copper portfolio.”

The Alturas project is considered a key development asset due to its high-quality resources and strategic location within the El Indio Belt, an area known for significant gold and copper mineralization. Boroo plans to develop the project in phases, focusing on optimizing resource extraction and maintaining sustainable operations.

Barrick’s decision to retain a small NSR royalty ensures continued participation in the project’s long-term value while allowing Boroo to take operational control. The optional repurchase of the royalty provides flexibility for Boroo to consolidate future returns once the project progresses.

The deal reflects Boroo’s ambition to expand its presence in South America and strengthen its portfolio with assets that combine exploration potential with established resource bases. For Barrick, the sale allows the company to reallocate capital to other strategic priorities while maintaining a limited interest in Alturas.

Alturas’ proximity to other major mining projects in the region also provides Boroo with potential synergies in logistics, infrastructure, and community engagement. The company emphasized that it will continue the practice of engaging constructively with local authorities and communities, in line with Barrick’s legacy, to ensure responsible and sustainable development.

Overall, the transaction represents a strategic move for both companies: Boroo gains a high-potential entry point into Chile, while Barrick streamlines its portfolio and retains a measure of participation in Alturas’ future production.

京公网安备 11010802046720号

京公网安备 11010802046720号