Wedoany.com Report-Aug. 8, China’s rare earth exports fell by 23% in July 2025, totaling 5,994.3 metric tons, compared to June’s record high, according to data released by the General Administration of Customs on August 7, 2025. June marked the highest export level since at least 2014, highlighting the volatility in China’s rare earth shipments, the world’s largest producer of these critical minerals.

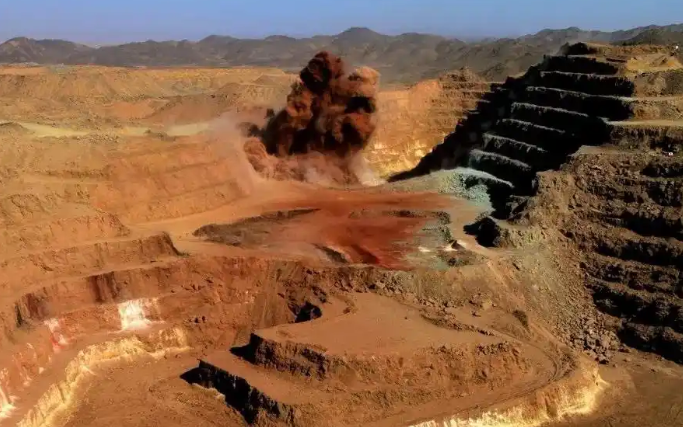

Workers transport soil containing rare earth elements for export at a port in Lianyungang, Jiangsu province, China October 31, 2010.

The July data, while significant, lacks detail on specific rare earth elements and related products, some of which face no restrictions. This incomplete dataset makes it challenging to assess China’s commitment to increasing shipments following recent agreements with the United States and Europe to streamline export licensing. These agreements, reached earlier in 2025, aimed to facilitate trade after export controls were introduced in April.

A comprehensive report, including data on rare earth magnet exports, is expected on August 20, 2025. Magnets, vital for industries such as automotive, electronics, and defense, saw increased shipments to the U.S. and Germany in July. This uptick reflects the critical role of these materials in global supply chains.

For the first seven months of 2025, China’s rare earth exports reached 38,563.6 metric tons, a 13% increase compared to the same period in 2024, demonstrating sustained global demand. In July, China issued its first 2025 mining and smelting quotas for rare earths, opting for a low-profile announcement compared to previous years.

Global efforts to diversify rare earth supply chains continue, with countries like the United States, Europe, and Australia exploring financial incentives to support alternative producers. Meanwhile, China maintains its dominant position in the sector, refining its production and export strategies to meet both domestic and international needs.

The volatility in export volumes, with double-digit fluctuations common, underscores the complexity of the rare earth market. As industries worldwide rely on these materials for high-tech applications, China’s export trends remain a focal point for global trade and manufacturing.

京公网安备 11010802046720号

京公网安备 11010802046720号