Wedoany.com Report-Sept. 25, Chinese demand for bauxite is significantly reshaping the global dry bulk market, with imports of the aluminium ore reaching record levels in 2025 and drawing increased attention to large carriers.

Between January and August 2025, port discharges of bauxite in China totaled 145.2 million tonnes, up 26% compared with the same period last year, according to vessel tracking data from AXSMarine. The year-to-date volume represents an increase of 30 million tonnes over 2024 and marks the strongest start ever for the trade.

Guinea remains the main supplier, accounting for 137.5 million tonnes and a 77% share of imports. Australia follows with 30.5 million tonnes, or around 17%, while smaller contributions come from Guyana, Turkey, Sierra Leone, and other exporters across West Africa, South America, and Asia.

The long-haul nature of shipments from Guinea has raised bauxite’s importance in tonne-mile demand. According to Ursa Shipbrokers, the commodity’s share of global dry bulk tonne miles has increased from 2% in 2015 to 8.5% in 2025, highlighting its growing role in capesize vessel employment.

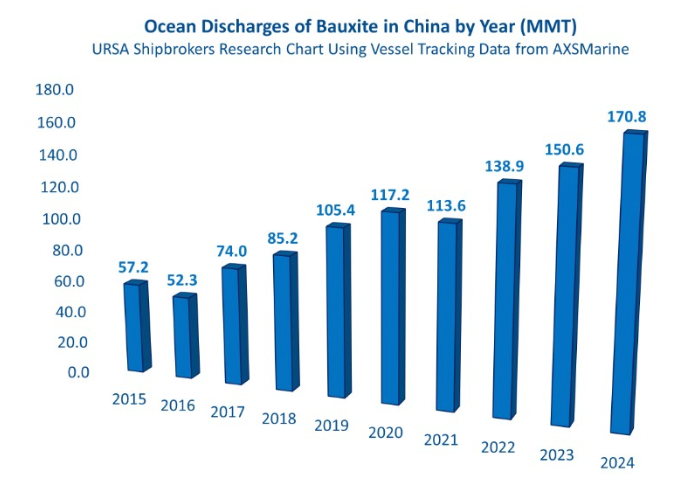

China’s bauxite imports have nearly tripled over the past decade, rising from 57.2 million tonnes in 2015 to 170.8 million tonnes in 2024. Despite short-lived disruptions in 2016 and during the 2021 pandemic, volumes have grown steadily in line with the country’s aluminium production expansion. Analysts at Ursa noted: “This expansion has been one of the most notable cargo growth stories for the dry bulk sector, underpinned by China’s vast aluminium smelting capacity and heavy reliance on imported bauxite.”

On the production side, Chinese aluminium smelters produced 3.8 million tonnes of primary aluminium in August 2025, matching record monthly output levels achieved in May and July. Cumulative production for the first eight months of 2025 reached 29.4 million tonnes, up 2.3% year on year.

The International Aluminium Institute estimates China produced 43.4 million tonnes of primary aluminium in 2024, more than fifteen times the output in 2000. Growth in aluminium demand has been driven by construction and electric vehicle industries, making bauxite imports one of the most significant drivers of expansion in dry bulk shipping.

Overall, China’s growing bauxite demand is not only reshaping trade patterns but also influencing global shipping dynamics. The combination of high volumes, long-haul shipments, and steady smelter output is positioning bauxite as a key driver for capesize vessel utilization and broader dry bulk market development.

This trend underscores the strategic importance of bauxite in China’s aluminium sector and highlights its continued impact on global shipping and commodity flows.

京公网安备 11010802046720号

京公网安备 11010802046720号