Wedoany.com Report-Oct. 17, A U.S. district judge is set to approve Rio Tinto’s $138.75 million settlement concerning its Oyu Tolgoi mine expansion in Mongolia. The lawsuit, filed by shareholders of Turquoise Hill Resources, alleged that the Anglo-Australian mining company misled investors regarding issues in the $7 billion underground expansion project.

In 2019, Rio Tinto disclosed the possible cost overrun of $1.9bn (£1.41bn), revising total capex to between $6.5bn and $7.2bn.

In June, a preliminary settlement was reached between Rio Tinto and Turquoise Hill shareholders, pending approval from U.S. District Judge Lewis Liman in Manhattan. At a recent hearing, Liman indicated his readiness to approve the settlement but has not yet signed off, as he awaits further information from shareholders’ lawyers on how the funds will be distributed. Rio Tinto has not admitted any wrongdoing under the terms of the agreement.

The lawsuit covered the period from July 2018 to July 2019, when Rio Tinto was the primary owner of Turquoise Hill. Shareholders, guided by Chicago-based Pentwater Capital Management, sought compensation for alleged misrepresentations. In a September 10 court filing, Pentwater stated that the settlement represents 34–43% of the damages it believed could be proven at trial and described the agreement as reasonable given the risks of continued litigation.

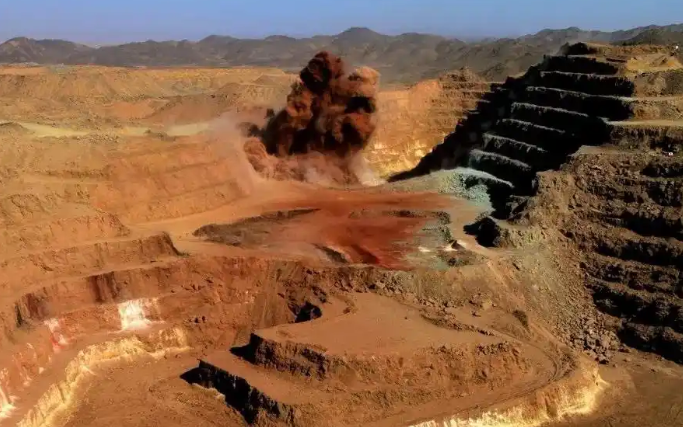

Turquoise Hill, which held a 66% stake in the Oyu Tolgoi mine, operates the project alongside the Mongolian government, which owns the remaining 34%. Pentwater has alleged that Rio Tinto and Turquoise Hill misled investors by asserting that the mine expansion was “on plan” and “on budget,” despite delays of up to two-and-a-half years and cost overruns reaching $1.9 billion. In 2019, Rio Tinto disclosed the potential cost overrun and revised the total capital expenditure for the project to between $6.5 billion and $7.2 billion.

The Oyu Tolgoi mine, one of the world’s largest copper projects, has long been a focal point of Mongolia’s mining sector. Rio Tinto fully integrated the mine into its copper portfolio in 2022 by acquiring the remaining 49% of Turquoise Hill that it did not already own for $3.3 billion.

The settlement represents an effort to resolve disputes with shareholders without prolonged litigation, ensuring that funds are distributed while avoiding the uncertainties of trial. Judge Liman’s approval would finalize the agreement, enabling shareholders to receive compensation for the alleged discrepancies in reporting and project management during the covered period.

Overall, the case underscores the challenges of large-scale mining projects with complex ownership structures, highlighting the importance of transparency and accurate reporting to investors. The Oyu Tolgoi expansion continues to be a strategic asset for Rio Tinto, contributing significantly to its global copper production and long-term portfolio planning.

京公网安备 11010802046720号

京公网安备 11010802046720号