Wedoany.com Report-Nov. 19, Barrick Mining (TSX: ABX) (NYSE: B) has entered an option agreement with Canadian junior Midland Exploration (TSXV: MD) for its Lewis property in Quebec. The deal allows Barrick to acquire up to 75% of the project by making C$750,000 in staged cash payments and investing C$12 million in exploration by 2032, with Midland acting as operator during the option period.

Under the agreement, Barrick can earn an initial 51% stake by paying C$250,000 to Midland and funding a minimum of C$3 million in exploration by 2028. After this initial earn-in, the companies will form a joint venture. Barrick then has the option to acquire an additional 9% interest by 2030 through C$200,000 in cash and C$1.5 million in exploration, and a further 15% by 2032 with C$300,000 and C$7.5 million in expenditure.

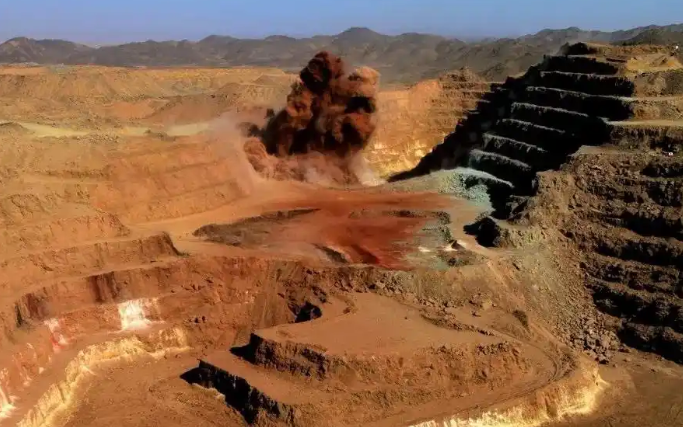

The Lewis property, acquired by Midland in 2020, covers 86 km² in Quebec’s Abitibi region and comprises 154 exclusive exploration rights. It is situated roughly 60 km northwest of Iamgold’s (TSX: IMG) (NYSE: IAG) Nelligan deposit, which hosts nearly 103 million tonnes of indicated resources grading 0.85 g/t gold, totaling 3.12 million ounces of gold.

This project is part of Midland’s Quebec-focused portfolio, which has previously seen partnerships with major mining companies including BHP, Rio Tinto, Centerra Gold, and Agnico Eagle Mines. The collaboration with Barrick adds to this strategy of leveraging partnerships to advance regional exploration projects.

Mark Hill, interim CEO of Barrick, said that North America is a key focus for the company’s future growth. This transaction aligns with Barrick’s strategic shift toward expanding its presence and operations in the region.

Following the announcement, Midland Exploration shares rose 1.2%, trading at C$0.45 each, giving the company a market capitalization of C$47.8 million ($34.2 million).

The agreement provides Barrick with a structured path to gain majority ownership while sharing operational responsibilities with Midland. By funding exploration in stages, Barrick can progressively assess the property’s potential and scale its investment in line with results. Meanwhile, Midland retains a management role throughout the option period, ensuring continuity of local operations and technical oversight.

The Lewis property’s location in the prolific Abitibi region positions it within a well-known gold-producing area with strong infrastructure and nearby established deposits. This strategic placement enhances the potential for resource expansion and supports Barrick’s broader objective of increasing North American reserves.

The partnership reflects a growing trend of collaborations between major and junior miners to efficiently advance exploration projects. By combining Barrick’s financial capacity and Midland’s operational expertise, the Lewis property is expected to progress rapidly through exploration milestones, with clear paths to additional ownership stakes over the next seven years.

京公网安备 11010802046720号

京公网安备 11010802046720号