Wedoany.com Report-Aug. 15, U.K.-based Centrica and U.S. investment firm Energy Capital Partners (ECP), part of Bridgeport Group, have agreed to acquire the Grain LNG terminal in Kent County, U.K., from National Grid, a British electricity and gas utility. The enterprise value of the transaction is approximately £1.5 billion. Centrica stated that its 50% share will be about £200 million after accounting for roughly £1.1 billion in new non-recourse project finance debt.

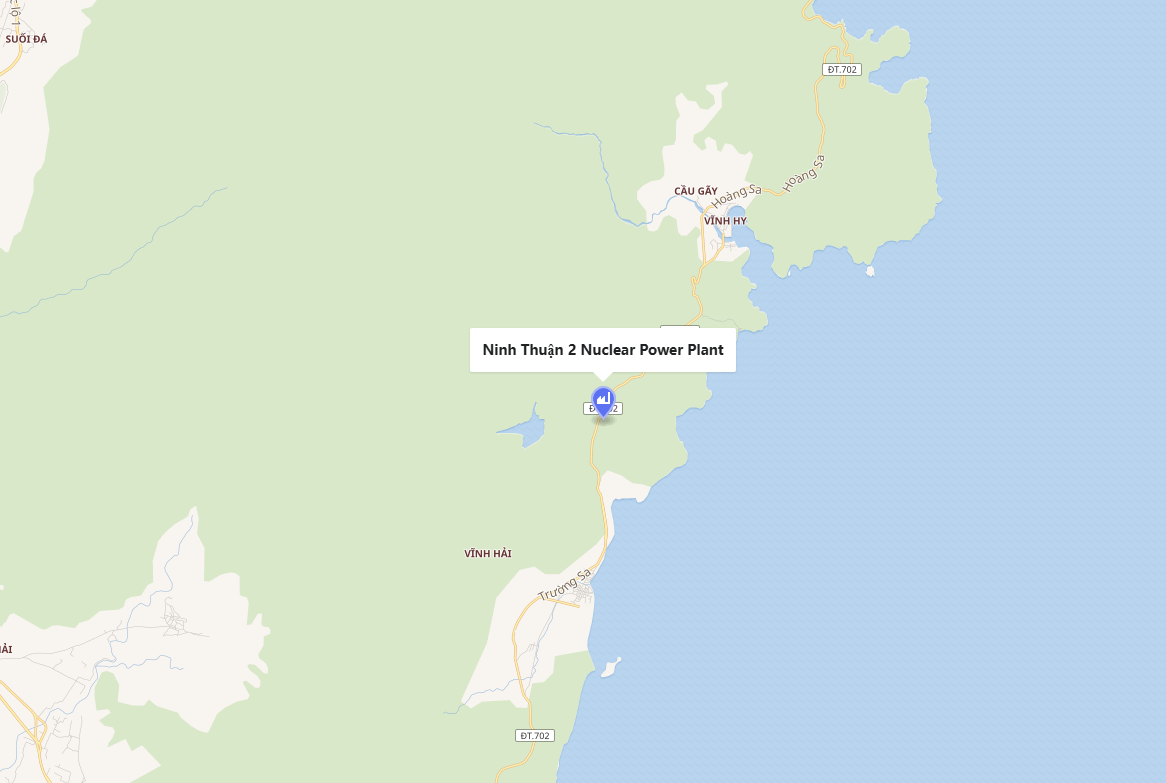

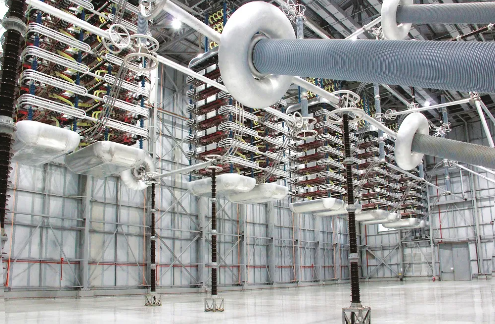

Grain LNG is described as Europe’s largest LNG regasification facility, with an annual capacity of 15 million tonnes. The acquisition aligns with Centrica’s strategy of investing in regulated and contracted assets that support the energy transition. Located on the Isle of Grain, the terminal is equipped with LNG unloading infrastructure, regasification systems, and truck-loading facilities. It has two jetties: one for LNG carriers with a capacity of 70,000–217,000 cubic meters (QFlex) and another for vessels of 125,000–266,000 cubic meters (QMax).

Tyler Reeder, President and Managing Partner of ECP, said: “With the emergence of the U.S. as the global leader in low-cost LNG supply and the growing need for reliable natural gas supply across the UK and Europe, we believe Grain LNG will increasingly be relied upon as critical infrastructure to deliver dependable energy to local markets.”

The terminal has been undergoing expansion to increase its storage and delivery capabilities to meet up to 33% of the U.K.’s gas demand. By 2025, its tank space is planned to reach 1.2 million tonnes, up from 1 million tonnes at the time of the expansion announcement. Future development options under consideration include a combined heat and power plant, bunkering facilities, and infrastructure for hydrogen and ammonia.

Chris O’Shea, Group Chief Executive of Centrica, commented: “The Isle of Grain terminal is a strategic asset that will support the UK’s energy security for many decades to come, keeping energy flowing reliably and affordably to households and businesses across the country as we transition to net zero. That’s why we are so pleased to be investing, continuing Centrica’s pivot towards long-term, predictable infrastructure cash flows, underpinning our medium-term guidance and creating valuable future options.”

National Grid expects the transaction to close later this year, subject to customary government and regulatory approvals. The utility views the sale as part of its strategy to focus on core network operations.

The deal also supports Centrica’s broader efforts to grow its LNG portfolio. In June, the company signed a heads of agreement with Thailand’s PTT for a ten-year LNG supply arrangement, with deliveries scheduled to begin in 2028.

This acquisition positions Centrica and ECP to strengthen their presence in the LNG infrastructure sector while enhancing long-term supply reliability for the U.K. market.

京公网安备 11010802046720号

京公网安备 11010802046720号