Wedoany.com Report-Aug. 18, On March 11, 2025, the UK’s Office of Gas and Electricity Markets (Ofgem) and the Department for Energy Security and Net Zero (DESNZ) released the Long Duration Electricity Storage (LDES) Technical Decision Document (TDD). The document outlines a cap and floor scheme to encourage investment in long-duration energy storage, modeled on the framework used for electricity interconnectors. It details the scheme’s operations, eligibility criteria, project assessment processes, financial parameters, and implementation steps.

The LDES TDD builds on the government’s October 2024 consultation response, which confirmed plans for a long-duration storage support mechanism. This aligns with the Clean Power 2030 Action Plan and Ofgem’s Forward Work Programme, aiming to boost large-scale energy storage projects. Ofgem will regulate and deliver the scheme, with its legal framework outlined in the Planning and Infrastructure Bill introduced in March 2025. Network charges will facilitate cost recovery, managing consumer support payments (floor) and revenue redistribution (cap).

The cap and floor scheme ensures a minimum revenue guarantee to protect investors while capping excessive profits to benefit consumers. A “soft cap” allows revenue sharing above the cap, and a “soft floor” supports financial stability. Further consultations on financial details are planned for 2025. Eligible projects must offer at least eight hours of storage, contribute to system flexibility and net-zero goals, and be located in Great Britain.

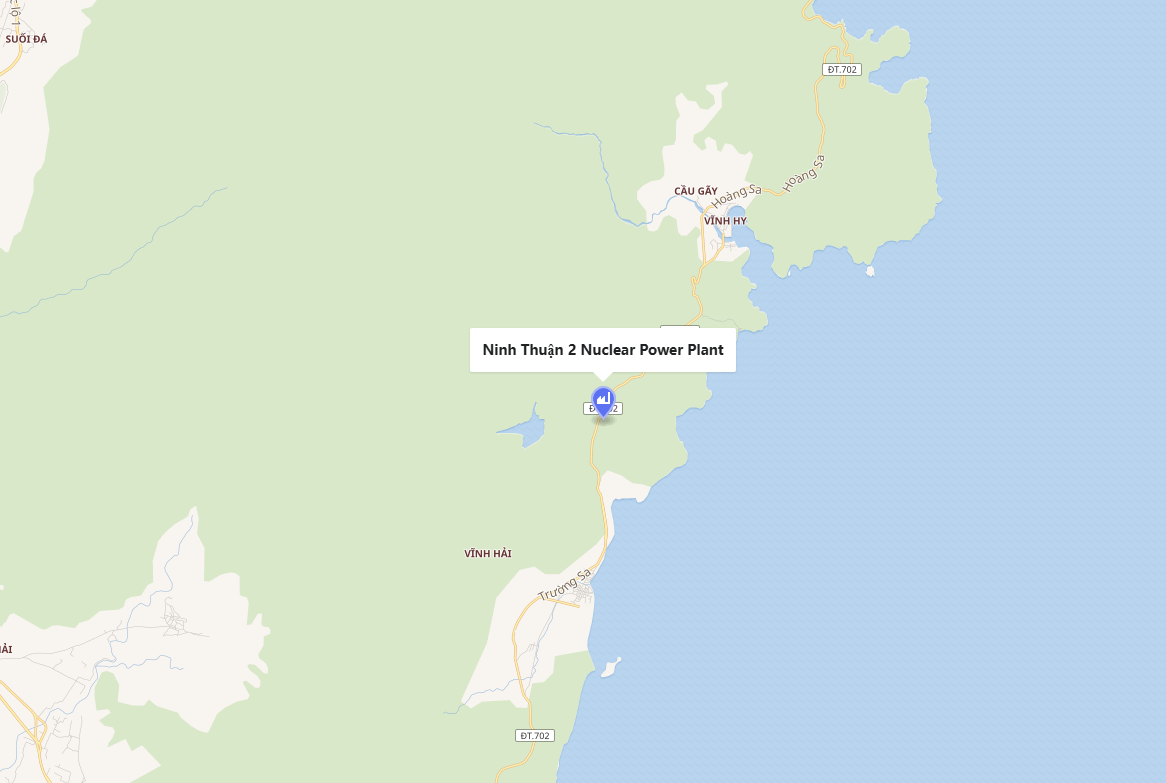

The first application window for LDES projects opened in Q2 2025, targeting 2.7 GW to 7.7 GW of additional storage capacity by 2035. “This scheme is a vital step toward enabling sustainable energy solutions,” said an Ofgem spokesperson. “It balances investor confidence with consumer benefits.”

Pumped storage hydro (PSH) projects face challenges, including a 25-year contract duration misaligned with their 50–100-year lifespans, potentially increasing consumer costs early on. Ofgem is exploring extended depreciation models to address this. Unclear post-regime revenue models may deter investment, but a proposed mechanism could allow revenue sharing to offset past consumer support. PSH’s high upfront costs and longer payback periods risk competitive distortions against shorter-duration technologies, prompting calls for tailored financial structures. Financing challenges persist due to standardized debt assumptions, with Ofgem considering project-specific debt adjustments. Regulatory complexity and restrictions on revenue stacking also pose hurdles, though a trial revenue-sharing mechanism aims to maintain market incentives.

The scheme recognizes PSH’s inertia benefits, critical for grid stability, within the “Other System Impacts” category. Ofgem may use shadow pricing, system security weighting, or minimum stability criteria to assess inertia, though its valuation remains complex without a formal market. “Inertia is essential for grid reliability, and we’re working to ensure its value is recognized,” said a DESNZ representative. Future market mechanisms could further integrate inertia valuation, supporting PSH’s role in the UK’s energy transition.

京公网安备 11010802046720号

京公网安备 11010802046720号