Wedoany.com Report-Aug. 28, Rio Tinto, a global mining company, has initiated a major restructuring led by its new Chief Executive, Simon Trott, who assumed the role on August 25, 2025, after heading the company’s iron ore division. The overhaul consolidates Rio Tinto’s operations into three core divisions: iron ore, copper, and aluminium-lithium, aiming to streamline its portfolio and enhance efficiency.

Simon Trott has reorganized the business into three main units.

The iron ore division, Rio Tinto’s primary profit contributor, will be led by newly appointed Chief Executive Matthew Holcz. This unified division integrates Western Australian operations, the Iron Ore Company of Canada, and the Simandou project in Guinea, which is set to commence operations. The restructuring focuses on optimizing these high-performing assets to drive profitability.

Certain mineral assets, including Richards Bay Minerals in South Africa, Canada’s iron and titanium operations, and U.S. borates mines, have been placed under review. Chief Commercial Officer Bold Baatar will oversee a strategic assessment to evaluate potential divestitures, addressing assets facing market challenges. The minerals division reported underlying earnings of $143 million in 2024, down from $312 million in 2023, and has been cash-flow negative for two years due to high growth spending and weak demand for borates and titanium dioxide, used in glass, cleaners, paints, and ceramics.

The aluminium and lithium businesses have been merged into a single division under Jérôme Pécresse, based in Montreal. This group includes Atlantic and Pacific Operations Aluminium and lithium assets, aligning with Rio Tinto’s focus on high-demand materials for sustainable technologies.

Leadership changes accompany the restructuring. Kellie Parker, former Chief Executive of Australia, who contributed to rebuilding Rio Tinto’s reputation following past controversies, and Sinead Kaufman, head of the minerals division, are leaving the company. The shake-up follows a challenging financial period, with Rio Tinto’s half-year profit in July 2025 reported at $4.8 billion, a 16% decline from the previous year and the lowest since 2020, driven by falling iron ore and lithium prices and rising operational costs.

Analysts at RBC Capital Markets commented: “The scope of the review appeared limited, noting they had expected possible divestments in aluminum, iron ore and lithium. They described the review of borates and titanium as low-hanging fruit in a portfolio facing competing demands for lithium investment.” The restructuring aims to address these market pressures while positioning Rio Tinto for long-term growth.

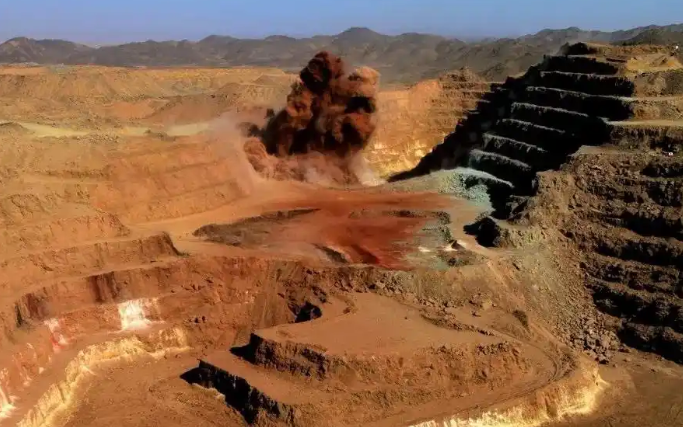

This strategic overhaul reflects Rio Tinto’s commitment to adapting its portfolio to market conditions, focusing on core assets, and exploring opportunities for operational efficiency. The changes are expected to strengthen the company’s position in key markets while supporting sustainable mining practices.

京公网安备 11010802046720号

京公网安备 11010802046720号