Wedoany.com Report-Sept. 5, Abu Dhabi National Energy Company PJSC (TAQA), JERA, and AlBawani Capital have announced the successful financial closing of two major greenfield gas power projects in Saudi Arabia. The developments, known as Rihab ElAwal Power Company (Rumah 2) and Nawras Power Company (Al Nairyah 2), will together provide about 3.6GW of power generation capacity.

The milestone follows the signing of two 25-year Power Purchase Agreements by the three partners. The plants, developed on a build, own, and operate model, will play an important role in meeting the Kingdom’s rising energy demand. With a combined investment value of approximately $4 billion, financing was arranged through senior debt and equity bridge loans from a consortium of leading regional and international financial institutions.

Ownership of the projects is structured with TAQA holding 49%, JERA 31%, and AlBawani 20%. Operation and maintenance will be managed by dedicated O&M companies formed under the same shareholding arrangement. The construction phase is already progressing, with early works recently completed.

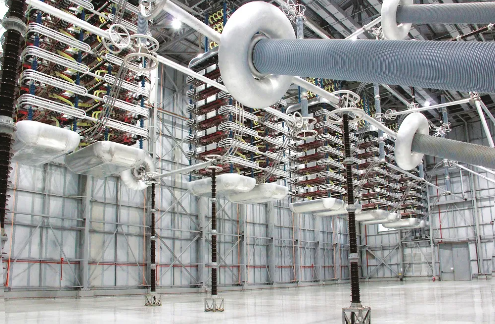

Engineering, Procurement, and Construction (EPC) contracts have been awarded to Harbin Electric International Co. Ltd and China Tiesiju Civil Engineering Group Co. Ltd. Both power plants will adopt advanced combined cycle gas turbine (CCGT) technology, designed with future readiness for carbon capture systems. Siemens Energy has been selected as the Original Equipment Manufacturer, and long-term service agreements have been signed to ensure reliable operations.

Farid Al Awlaqi, chief executive officer of TAQA’s Generation business, said: “We are proud to have reached financial close, an important milestone in the progress of the projects… Notably, the construction of both plants is well underway with the early works phase concluding recently. We are developing the plants to be built for the future utilising the highest efficiency CCGT turbines, which demonstrates our firm commitment to growth and decarbonisation.”

Steven Winn, chief global strategist at JERA, stated: “The projects will strengthen JERA’s presence and contribution to the Kingdom in securing a reliable and sustainable energy supply. The projects shall have decarbonisation provision in line with JERA’s goal of achieving net-zero by 2050. We congratulate all stakeholders on achieving this major milestone.”

Eng. Fakher AlShawaf, group chief executive officer of AlBawani Holding, added: “Achieving financial close marks a significant milestone in AlBawani’s ongoing commitment to supporting the Kingdom’s energy transition, in alignment with the ambitious goals of Vision 2030, and in partnership with TAQA and JERA. These strategic projects will deliver reliable, sustainable energy solutions and contribute meaningfully to Saudi Arabia’s long-term growth and prosperity.”

With advanced technology integration, strong international partnerships, and long-term agreements in place, the Rihab ElAwal and Nawras power plants are positioned to become key assets in Saudi Arabia’s energy sector.

京公网安备 11010802046720号

京公网安备 11010802046720号