Wedoany.com Report-Oct. 12, Chile's state-owned mining company Codelco has recorded its lowest copper output in over 20 years, impacted by a recent mine collapse that hindered ongoing recovery from a lengthy production downturn. Data from the Chilean Copper Commission (Cochilco), released yesterday, showed August production at 93,400 tonnes, marking a 25% decline from the same month in the previous year.

Codelco produced 93,400t of copper in August, a 25% decrease from the same month last year.

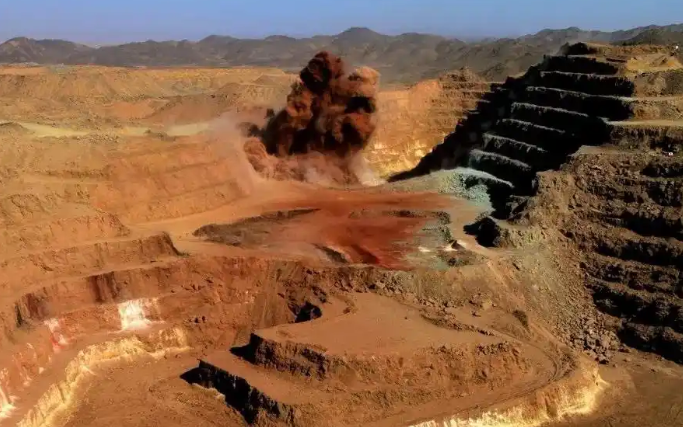

The setback stems from an accident at the El Teniente mine on July 31, triggered by an earthquake near the Andesita section of its vast underground tunnel system. The event caused six deaths and nine injuries, suspending operations for more than a week and prompting Codelco to revise its yearly output forecast downward.

Codelco estimates the collapse led to a loss of about 33,000 tonnes in production. While activities have restarted in unaffected zones, this marks the most severe incident in Chile's mining sector in three decades, testing the company's position as the global leader in copper production.

The occurrence highlights growing supply uncertainties in the international copper market, driven by heightened needs from renewable energy initiatives and expanding data centers. Copper's essential role in these areas amplifies the effects of such disruptions on availability and pricing.

In contrast, the Escondida mine, managed by BHP Group, yielded 105,100 tonnes in August. Although this figure dipped slightly from July, it held steady compared to the prior year, per Cochilco figures. Escondida continues to operate as the world's top copper mine, demonstrating resilience amid variable conditions.

The Collahuasi mine, a joint venture between Anglo American and Glencore, saw a modest uptick in output from July. Nonetheless, volumes remain under last year's benchmarks, influenced by phases of lower-grade ore processing.

Codelco's challenges underscore the complexities of maintaining high production in underground mining environments, where geological factors and safety protocols intersect. The company is focusing on stabilizing operations at El Teniente, implementing enhanced monitoring and support systems to prevent future issues.

Recovery efforts at Codelco involve optimizing other facilities and investing in technological upgrades to boost efficiency. These steps aim to mitigate the slump's broader impact and align with long-term goals for sustainable output.

The global copper landscape benefits from diversified production sources, as seen in the performance of Escondida and Collahuasi. However, incidents like the El Teniente collapse remind stakeholders of the need for robust contingency planning to ensure steady supply chains.

As demand pressures mount, Chile's mining sector remains pivotal, contributing significantly to the nation's economy. Codelco's response to this event will shape its trajectory, potentially influencing market dynamics in the coming months.

京公网安备 11010802046720号

京公网安备 11010802046720号