Wedoany.com Report-Oct. 15, Canada-based IsoEnergy has entered an agreement to acquire all shares of Australian operator Toro Energy for A$75 million ($48.9 million), adding the Wiluna uranium project in Western Australia to its portfolio. The transaction, announced on October 10, 2025, offers Toro shareholders 0.036 IsoEnergy shares per Toro share, equating to a 7.1% stake in the combined company. This represents a 79.7% premium over Toro’s closing price of A$0.325 and a 92.2% premium over its 20-day volume-weighted average price.

Upon completion, the merged company will possess a consolidated resource base of 55.2mlb of uranium oxide (measured and indicated).

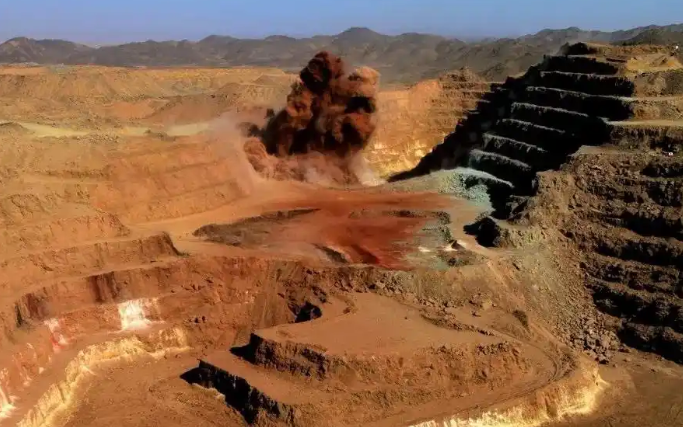

The acquisition integrates Toro’s fully owned Wiluna uranium project, located in Western Australia’s northern goldfields, into IsoEnergy’s diverse portfolio. IsoEnergy’s assets include the high-grade Hurricane deposit in Canada’s Athabasca basin, several past-producing mines in the United States, and various uranium exploration and development projects in top-tier mining regions.

IsoEnergy CEO and Director Philip Williams stated: “The acquisition of Toro Energy marks another important step in advancing IsoEnergy’s strategy to build a globally diversified, development-ready uranium platform. The Wiluna Uranium Project strengthens our portfolio with a large, previously permitted asset in a top-tier jurisdiction at a time when global nuclear demand is accelerating. This transaction positions IsoEnergy to deliver meaningful scale, optionality and sustained value creation for shareholders. We look forward to welcoming the Toro team, who have done an admirable job stewarding the company and its projects through often challenging markets, to IsoEnergy and advancing the project together.”

Toro Executive Chairman Richard Homsany added: “The Toro team will benefit from the significant financial strength of ISO and looks forward to working together on the successful development of the Wiluna Uranium Project for all stakeholders.”

The merged entity will hold a consolidated resource base of 55.2 million pounds of uranium oxide (measured and indicated) and 4.9 million pounds inferred, per National Instrument 43-101 standards, alongside 78.1 million pounds (measured and indicated) and 34.6 million pounds inferred under Joint Ore Reserves Committee standards. This positions the company to capitalize on a growing uranium market, with the World Nuclear Association projecting a 30% increase in global uranium demand by 2030 and more than double by 2040.

Toro’s independent board committee unanimously recommends that shareholders support the transaction, provided no superior offer emerges. Mega Uranium, holding a 12.7% stake in Toro, has indicated its support for the deal. In October 2024, IsoEnergy formed a joint venture with Purepoint Uranium Group to explore uranium properties in Saskatchewan’s Athabasca basin, further expanding its global footprint.

京公网安备 11010802046720号

京公网安备 11010802046720号