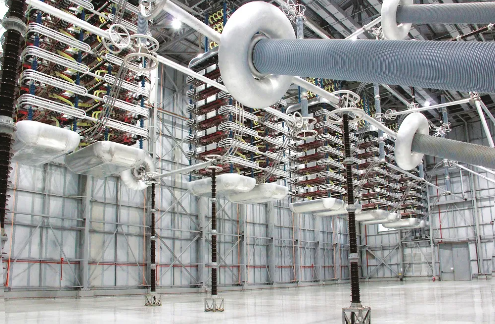

Wedoany.com Report-Oct. 17, Copenhagen Infrastructure Partners (CIP) has reached an agreement to transfer a 50% ownership interest in the Coalburn 2 project to funds under AIP Management. Coalburn 2 is a 500MW lithium-ion battery energy storage system with a two-hour duration, located in South Lanarkshire, southern Scotland. The ownership shift to AIP will occur following the site's commissioning, expected in 2027.

Coalburn 2 is one of three transmission-connected BESS assets co-developed by Alcemi and CIP.

The deal was executed by CIP representing its Copenhagen Infrastructure IV fund. Once operational, Coalburn 2 will rank among Europe's largest battery storage facilities, supporting grid reliability and the incorporation of renewable energy sources, as noted by CIP. The company made the financial investment decision for the project in December 2024 and will continue overseeing its development through the ongoing construction stage.

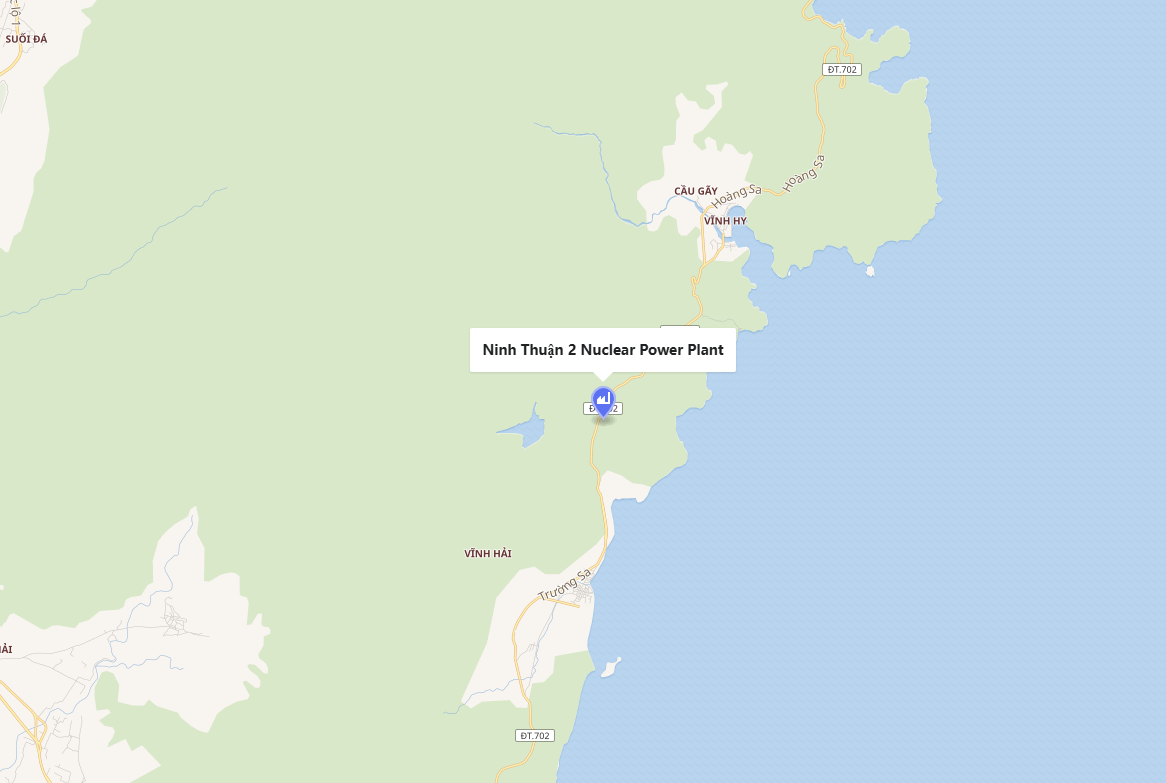

Coalburn 2 includes a ten-year optimization contract with SSE and a 15-year capacity market agreement. It forms part of three transmission-connected battery energy storage assets co-developed by CIP and Alcemi, all under construction in Scotland. Together, these facilities offer 1.5GW of power capacity and 3GWh of storage, sufficient to supply electricity to over 4.5 million households for two hours.

CIP is advancing an additional 4.5GW of battery energy storage projects across Scotland and England. AIP focuses on investments in assets that are prepared for construction or already operational, minimizing exposure to initial development uncertainties. This move aligns with AIP's recent purchase of a 2.4GWh portfolio of operational and in-progress battery storage projects in the UK. Overall, AIP's portfolio now encompasses around 7GW in capacity, projected to offset approximately ten million tonnes of greenhouse gas emissions.

“This investment reinforces our conviction in the UK energy storage market and reflects our strategy of partnering selectively on high-quality, ready-to-build or operational assets. Together with our recent Ardenham investment, it forms part of a growing portfolio that combines strong downside protection with long-term value creation,” said AIP partner and co-head of investments Greg Falzon.

“As CIP’s development and construction portfolio of UK BESS projects continues to progress and grow, we look forward to welcoming AIP as a new partner on our Coalburn 2 site, which once commissioned in 2027 will be one of Europe’s biggest operational BESS projects. The delivery of Coalburn 2, alongside CIP’s Coalburn 1 and Devilla projects, will improve the UK’s energy security, enable more low-cost renewables to be delivered, and reduce costs for British consumers through enhanced system flexibility,” said CIP partner Nischal Agarwal.

In a separate development this August, CIP obtained full ownership of the Beehive battery energy storage system, a 1GWh facility in Arizona, United States, from EDF Power Solutions North America. This acquisition underscores CIP's expanding presence in global energy storage markets, contributing to sustainable infrastructure growth.

The partnership between CIP and AIP highlights collaborative efforts in the energy sector, aiming to bolster storage capabilities and support the shift toward renewable-dominated power systems in the UK and beyond.

京公网安备 11010802046720号

京公网安备 11010802046720号