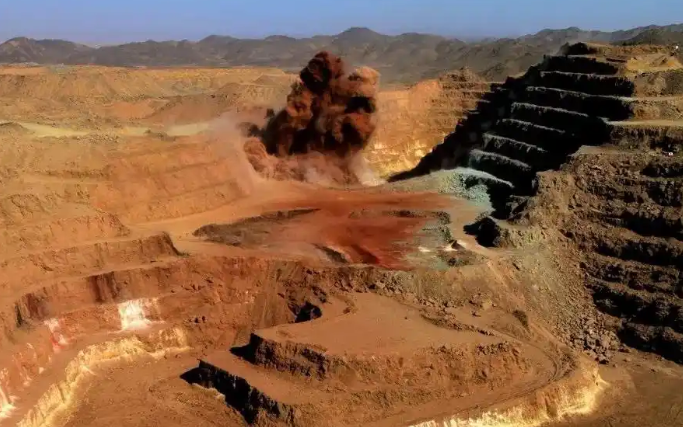

Wedoany.com Report-Aug. 15, Denison Mines, a Canadian uranium exploration and development company, has priced a $300 million (C$414.05 million) offering of convertible senior unsecured notes due in 2031. The offering includes an option for initial buyers to purchase an additional $45 million in notes. The funds will support the company’s uranium development initiatives, including the Wheeler River project in northern Saskatchewan, Canada.

Denison plans to allocate the net proceeds towards the evaluation and development of its uranium projects.

The notes will carry a semi-annual interest rate of 4.25%. Denison plans to use the net proceeds to advance the evaluation and development of the Wheeler River project, located on the eastern side of the Athabasca Basin, and for general corporate purposes. The offering is expected to close around August 15, 2025, subject to standard conditions and approvals from the Toronto Stock Exchange and NYSE American.

The initial conversion rate for the notes is set at 342.9355 shares per $1,000 principal amount, equivalent to a conversion price of approximately $2.92 per share. This represents a 35% premium over the share closing price on August 12, 2025, with adjustments possible under specific conditions. Denison may redeem the notes in certain scenarios, while noteholders can request repurchase under defined circumstances.

To manage potential dilution from note conversions, Denison has entered into capped call transactions with initial purchasers and financial institutions, funded by the offering proceeds or existing cash reserves. These transactions aim to limit dilution and offset excess cash payments required upon conversion, up to a predetermined cap.

Denison’s counterparties in the capped call transactions have indicated they may engage in derivative transactions involving the company’s shares around the time of the notes’ pricing. Such activities could influence the market price of Denison’s shares or the notes. Additionally, the counterparties may adjust their hedge positions through derivative or secondary market transactions, potentially affecting the share price and noteholders’ conversion outcomes.

The Wheeler River project, a key focus of the funding, underscores Denison’s commitment to advancing its uranium development portfolio. The company aims to strengthen its position in the global uranium market while maintaining financial flexibility through strategic initiatives like this offering.

京公网安备 11010802046720号

京公网安备 11010802046720号