Wedoany.com Report-Aug. 31, ACWA Power, in collaboration with the Saudi Electricity Company (SEC) and Korea Electric Power Corporation (KEPCO), announced the financial closure of two independent power producer projects, Rumah 1 and Nairyah 1, in Saudi Arabia on August 26. These projects, with a combined investment of SR15 billion ($4 billion), will provide a total capacity of 3,600MW, supporting the nation’s strategy for a reliable and sustainable energy mix.

The projects support ACWA Power’s own target of net zero by 2050 and the country’s commitment to net-zero emissions by 2060.

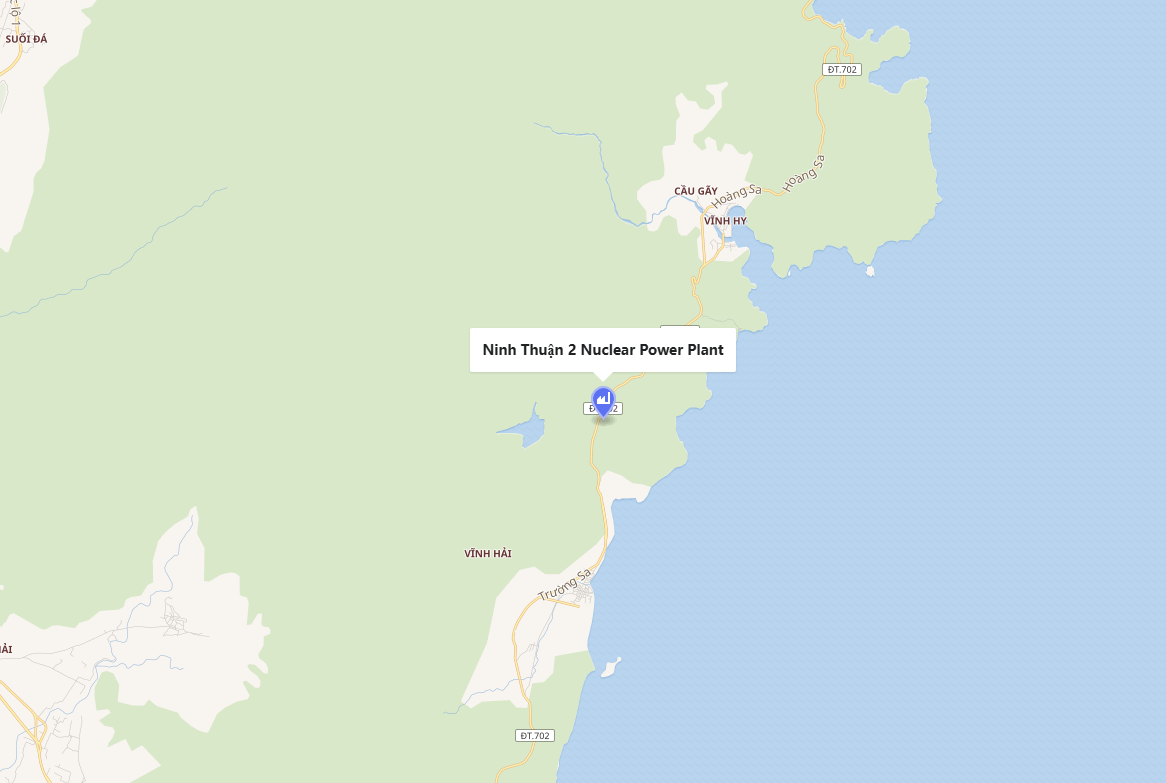

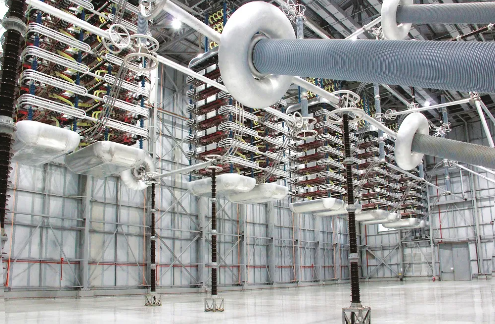

The Rumah 1 project, located in Riyadh Province, involves the construction of a 1,800MW combined cycle gas turbine power plant, managed by Remal Energy Company with a $2 billion investment. The Nairyah 1 project, situated in the Eastern Province, will also develop a 1,800MW power plant, operated by Naseem Energy Company with an equivalent $2 billion investment. Ownership is distributed among ACWA Power (35%), SEC (35%), and KEPCO (30%).

Funding was secured from a consortium of lenders, including the Agricultural Bank of China, Bank of China, Industrial and Commercial Bank of China, Arab Petroleum Investments, Banque Saudi Fransi, Export-Import Bank of Korea, Saudi Investment Bank, Saudi National Bank, and Standard Chartered Bank. The inclusion of export credit financing underscores the projects’ alignment with global sustainability goals.

Thomas Brostrom, ACWA Power’s chief investment officer, stated: “The successful achievement of financial closure of the Rumah 1 and Nairyah 1 IPP projects underscores the investor confidence in ACWA Power’s strategic vision and our proven track record in delivering sustainable power solutions. Securing financing from such a diverse group of lenders demonstrates the bankability of these projects and their alignment with global sustainability objectives. We are particularly pleased with the inclusion of export credit financing, which further validates the international significance of these projects. This financial achievement reinforces our commitment to providing reliable and cost-effective power while actively pursuing innovative solutions for a cleaner energy future.”

Abdulrahim Alharbi, acting CEO of SEC’s Energy Infrastructure Consortium Company, stated: “The successful financial closure of the Rumah 1 and Nairyah 1 IPP projects is a testament to the strength of our partnerships and the Kingdom’s credibility in attracting strategic investments in the energy sector.”

Designed for future adaptability, the projects can integrate carbon capture technology, supporting ACWA Power’s net-zero target by 2050. The Saudi Power Procurement Company will oversee tendering and serve as the primary buyer. In July 2025, ACWA Power signed agreements to develop a green hydrogen and renewable energy export chain to Europe, reinforcing global energy connectivity.

These initiatives enhance domestic energy production and foster international collaboration, contributing to sustainable energy development in Saudi Arabia.

京公网安备 11010802046720号

京公网安备 11010802046720号