Wedoany.com Report-Oct. 14, Saudi Aramco Chief Executive Amin Nasser said on Monday that the company can sustain crude oil production at 12 million barrels per day (bpd) for an entire year without incurring additional costs. He made the remarks at the Energy Intelligence Forum in London, noting that Saudi Arabia holds a large portion of the world’s spare oil production capacity, which can be quickly brought to market when needed.

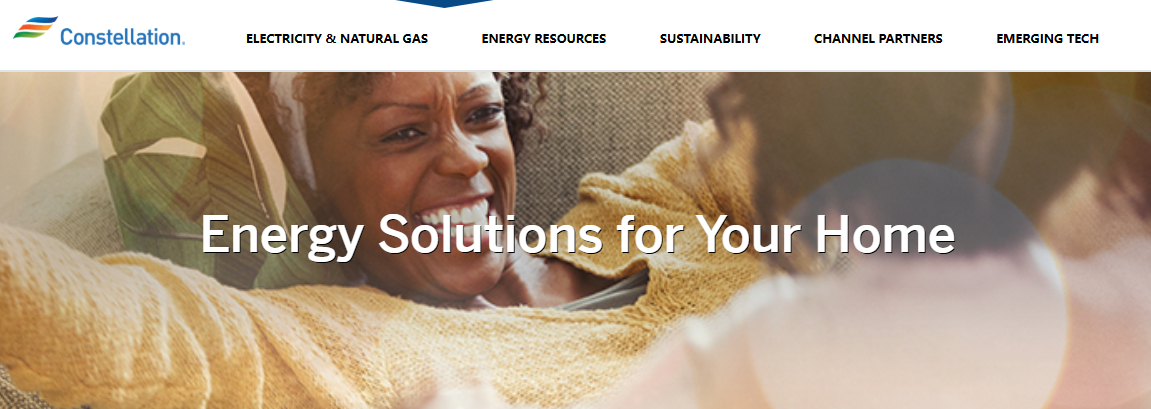

A view shows branded oil tanks at Saudi Aramco oil facility in Abqaiq, Saudi Arabia October 12, 2019.

Nasser said global oil demand is expected to increase by 1.1 million to 1.3 million bpd in 2025, and by 1.2 million to 1.4 million bpd in 2026. He added that Aramco’s extraction costs remain among the lowest in the industry, averaging $2 per barrel of oil equivalent (boe) for oil and $1 per boe for gas. “We are determined to remain dominant in oil thanks to a massive resource base, low costs, and one of the lowest upstream carbon intensities across the industry,” Nasser said. “We also see resilient demand, and the pressing need for long-term investments in supply is now widely accepted.”

Earlier this year, Saudi Arabia’s energy ministry directed Aramco to revert its maximum sustainable capacity target to 12 million bpd, down from the previously planned 13 million bpd. The decision reinstated the production ceiling that had been in place before March 2020. According to the International Energy Agency, Saudi Arabia’s spare production capacity stood at 2.43 million bpd in August, out of a total 4.05 million bpd held by OPEC+. The Kingdom produced more than 9.7 million bpd of crude that month.

As the world’s largest oil exporter, Aramco continues to focus on maintaining efficiency in its upstream operations while expanding its downstream and petrochemical businesses to diversify revenue sources. Nasser said that chemicals remain a long-term growth area for the company, despite weaker global demand in recent quarters. “Despite the current downturn, chemicals remain a key long-term growth area, with our proven strengths in both feedstocks and conversion,” he said.

Aramco has been expanding its petrochemical portfolio through strategic partnerships and acquisitions. In October, the company obtained majority control of Petro Rabigh by acquiring a 22.5% stake from Sumitomo Chemical. In July, it purchased a 10% stake in China’s Rongsheng Petrochemical for $3.4 billion, securing access to a 400,000 bpd refinery.

In addition, Aramco is jointly developing an $11 billion petrochemical complex with TotalEnergies at the existing Satorp refinery in Saudi Arabia. The new facility is expected to produce 1.65 million metric tons of ethylene annually starting in 2027. TotalEnergies said last month that it plans to expand its operations in Saudi Arabia due to competitive feedstock and energy costs, even as it scales down some of its European activities.

Through these projects, Aramco aims to strengthen its global market position, balance its energy portfolio, and ensure long-term growth across both traditional and value-added sectors.

京公网安备 11010802046720号

京公网安备 11010802046720号