Wedoany.com Report-Oct. 16, Skycorp Solar Group, a supplier of photovoltaic products based in Ningbo, China, has announced plans to purchase a 24% equity interest in Nanjing Cesun Power for about $8.7 million. The transaction involves issuing 12 million Class B ordinary shares to Skyline Tech Ltd., the current holder of the stake.

These new shares come with a five-year restriction period, resulting in Skyline Tech owning over 13 million Class B ordinary shares in Skycorp. This ownership equates to 97% of the company's voting rights.

The agreement is anticipated to finalize on or before December 20, pending standard completion requirements.

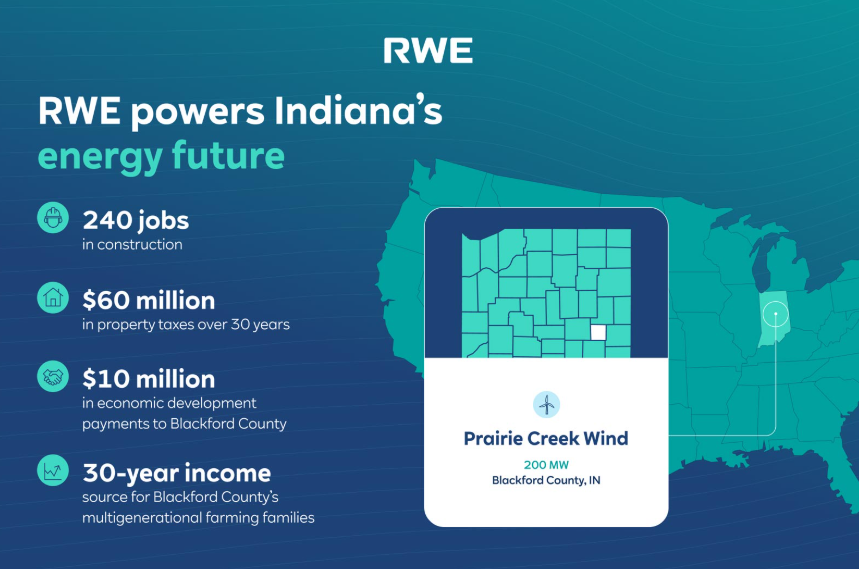

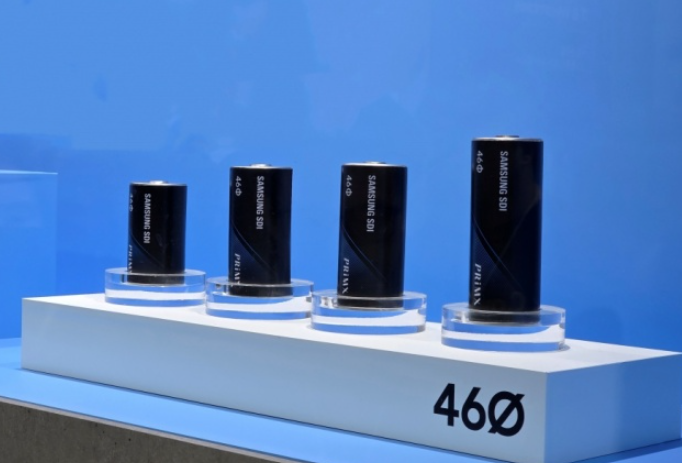

Skycorp's current offerings center on solar components, including cables and connectors. In contrast, Nanjing Cesun Power specializes in advancing new energy power facilities and inverter systems.

Skycorp CEO Weiqi Huang commented: “marks a strategic extension of the company’s investments into AI-driven energy technologies and green energy solutions.” He further noted: “create new drivers of sustainable growth for the company.”

This acquisition aligns with broader efforts to integrate advanced technologies into renewable energy operations.

Recently, Skycorp's investors approved a measure to combine its authorized, issued, and circulating shares. The plan allows for converting every 100 current shares—or a lesser agreed amount, at minimum 10—into a single updated share. These revised shares will retain identical privileges and limitations as the originals, aside from nominal value.

According to a company release, partial shares will not be distributed; instead, quantities will be adjusted upward to the closest full unit as needed.

Implementation of this share adjustment requires endorsement from the board of directors over the coming three years. Investors have empowered the board to execute all required steps for the consolidation, should they choose to move forward.

The initiative provides flexibility to streamline the company's capital structure in response to market dynamics.

In November 2024, Skycorp submitted an application for its initial public listing to the United States Securities and Exchange Commission, targeting the Nasdaq exchange. The filing proposed selling 2.7 million shares at prices ranging from $4 to $5 apiece, aiming to secure up to $13.5 million in proceeds. Trading commenced on the exchange in early March 2025.

This listing has enhanced Skycorp's visibility and access to international capital markets, supporting its expansion in the solar sector.

The combination of the stake purchase and share restructuring positions Skycorp to strengthen its portfolio in photovoltaic and energy storage innovations. By partnering with Nanjing Cesun Power, Skycorp gains expertise in power plant development and inverter advancements, complementing its established component manufacturing.

These steps reflect a commitment to fostering long-term value in sustainable energy solutions. The lock-up provision ensures stability in ownership, while the potential share consolidation could optimize the equity framework for future opportunities.

Overall, Skycorp's strategic moves underscore its focus on growth within the global renewable energy landscape, benefiting from synergies between hardware production and system integration.

京公网安备 11010802046720号

京公网安备 11010802046720号