Wedoany.com Report-Aug. 28, Foresight Solar Fund, a UK-based renewable energy investment company, has agreed to sell its 50% stake in the 50MW Lunanhead battery storage project in Perthshire, Scotland. The transaction, announced on August 28, 2025, involves a third-party buyer and aligns with the asset’s carrying value from June 2025. The deal, co-owned with Foresight Environmental Infrastructure Fund, is expected to finalize within the third quarter of 2025.

The company is also evaluating options for its 50% stake in the 50MW Clayfords battery storage project. These options include further development, share buybacks, or debt repayment, reflecting a strategic approach to optimizing its portfolio. This review aims to enhance financial flexibility while supporting the company’s long-term objectives in renewable energy.

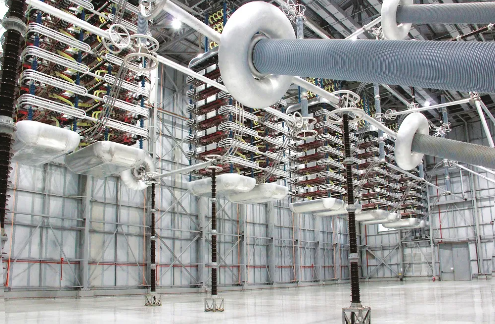

In a separate development, Foresight Solar Fund confirmed that the 50MW Sandridge Battery Energy Storage System (BESS) in Wiltshire, co-owned with FGEN, has been energized. The site is currently undergoing final commissioning and testing to prepare for full commercial operations. This milestone marks progress in expanding the company’s operational battery storage capacity, contributing to grid stability and renewable energy integration.

Foresight Solar Fund stated: “The transaction is expected to complete later this quarter.” The sale of the Lunanhead stake demonstrates the company’s focus on aligning asset management with market opportunities, ensuring value for investors while supporting the UK’s energy transition.

The Lunanhead and Clayfords projects highlight the growing importance of battery storage in managing renewable energy supply and demand. By divesting its stake in Lunanhead, Foresight Solar Fund is reallocating resources to maximize portfolio efficiency. Meanwhile, the Sandridge BESS project strengthens the company’s commitment to operational assets that support the UK’s renewable energy infrastructure.

These developments reflect Foresight Solar Fund’s strategic approach to managing its renewable energy portfolio, balancing divestitures with operational advancements. The sale of the Lunanhead stake and the energization of Sandridge BESS contribute to the company’s efforts to support sustainable energy solutions while maintaining financial discipline. The ongoing review of the Clayfords project further underscores Foresight’s focus on optimizing its investments to meet market demands and enhance grid reliability.

By advancing battery storage projects and strategically managing its assets, Foresight Solar Fund is supporting the UK’s transition to a cleaner energy future. These initiatives are expected to bolster energy security and promote sustainable economic growth in the region.

京公网安备 11010802046720号

京公网安备 11010802046720号